HMRC have now provided more information about the increase in National Insurance Contributions (NICs) to be applied from April 2022 until March 2023 to fund the NHS, health and social care. Here is some information to help you plan your costs for 2022-23 and the coming years.

Employees

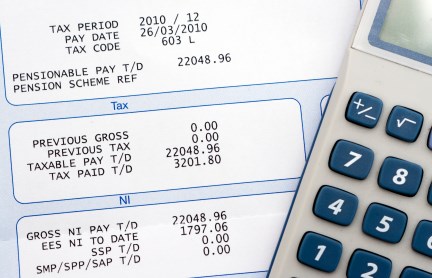

Employees who earn above £184 per week (£797 per month) will pay an additional 1.25% in NICs meaning 13.25% will be deducted from earnings above this level. Employers will also pay an additional 1.25% on an employee's earnings above £170 per week (£737 per month) taking their NICs to 15.05%.

These contributions will not apply where an employee is under 21, an apprentice under 25 or an Armed Forces veteran in their first year of employment as there are no NICs applied to these employees. Those above state pension age will also not pay the additional contribution because they do not pay National Insurance, but their employers will have to make the additional contribution.

Businesses will still be able to claim the £4,000 Employment Allowance each year which means no Employers' NICs are due during the year until that £4,000 has been used. Any unused allowance at the end of the tax year cannot be carried forward.

Self-Employed

The self-employed will pay an additional 1.25% on earnings above the Lower Profits Limit of £9,568 taking their total NIC to 10.25%. There will be no additional amount to pay if profits are below this level as they will only be making Class 2 contributions.

From April 2023 onwards

The Health and Social Care Levy will be applied from April 2023. The employee and employers’ NICs will reduce back to their 2021-22 rates and the 1.25% Levy will be shown as a separate deduction. The total deduction will remain the same and will be paid to HMRC along with the other deductions for tax and NI.

Employees of state pension age will contribute to the Levy from April 2023 alongside their employers.

Self-employed persons above and below state pension age will contribute to the Levy from April 2023 when their earnings exceed the Lower Profits Limit. If earnings are below this level they will not pay a Levy.

Summary

With the National Living Wage rising to £9.50 per hour for those aged 23 and above and this increase in NICs, employers will need to plan for the increased costs in their business.

For employees there will be no change in the tax free personal allowance of £12,570 until March 2026.