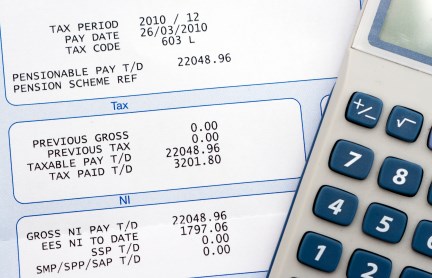

Every employee will have a tax code and this determines how much tax is deducted from your pay.

Your tax code is unique to you, and whilst many employees will have the standard tax code (currently 1257L in 2023-24), many others will have something different so you cannot compare your tax code with someone else's.

When you start work with an employer for the first time you will be asked to complete a starter form. The questions on this form will determine what tax code you are put on by the payroll provider. It could be the standard one or it could be BR (Basic Rate) if you have shown that you have another job or a pension. Once your first pay is submitted to HMRC they will notify your payroll provider of any change required to the tax code which has been used. You will also receive a notification from HMRC showing how your tax code is calculated. If you disagree with the tax code you must call HMRC yourself to discuss it - your employer or payroll provider cannot do this for you.

When you finish one job and start a new job you will be given a P45 from your old job which you should hand to your new employer. The details on this P45 are used to set you up on the new employer's payroll and ensures that your earnings for the year so far are recorded in the new payroll along with the correct tax code. If there is to be a change to the tax code HMRC will notify the employer soon after the first payroll processing. Again if you disagree with the tax code notification you will also have been sent you should contact HMRC yourself as your employer cannot do this for you.

There are many reasons why you may not have a standard tax code.

- You may have other income and choose for one or other of your earnings to receive your tax free allowance, whilst the other earnings has no tax free allowance.

- You may have tax due on other income, such as rent from a property, and have chosen for the tax due on this to be taken from your employed pay.

- You may owe tax from previous years and this could be being recovered from your current earnings - you will be paying more than the basic rate of tax.

- You may have given 10% of your tax free allowance to your partners or received 10% of their tax free allowance

- You may receive expenses or benefits from your employer which are taxable - health insurance, a company car or accommodation. The tax due on these will be deducted from your pay so you will have less tax free allowance.

- You may be receiving a pension as well as being employed and your tax free allowance will be shared between both sources of income

Everyone in employment or receiving income should receive a tax code notification from HMRC prior to the start of each tax year. This will give you your tax code for the new tax year and set out how this is calculated taking into account all sources of income and benefits.

The standard tax free allowance is £12,570 per annum, which gives the standard tax code of 1257L.

Some tax codes will have a different letter at the end of maybe made up of just letters. Each has a different meaning.

- If there is a K code at the front of your code you do not have any personal allowance and tax is being recovered at a higher rate - usually due to additional tax being owed.

- If your tax code is D0 or D1 you are taxed at the higher rate or the additional rate.

- If your tax code is NT you are not paying any tax.

It is helpful to understand the tax code which is being used to calculate the tax due on your pay to ensure you are not paying too much or too little tax. Many employers will put a new employee on to a BR tax code and if they don't change it during the year it means you are not receiving your tax free allowance and are therefore paying too much tax.

Check now the tax code which is being used for your pay. You can also check the tax code which HMRC has given you by logging into your personal Government Gateway account. This will also show your earnings to date.